Are you ready to become a ridiculously amazing insurance agent in 2021? If so, we are ready to help you lead the charge and conquer your biggest goals and dreams. You may be asking, what is a ridiculously amazing insurance agent? The video above will help guide you along, but we are happy to further the cause in this blog. Here is what it takes to be a Ridiculously Amazing Insurance Agent in 2021.

I am a Ridiculously Amazing Insurance Agent Who:

-

Outlasts the suck of change

-

Enthusiastically tries

-

Is never busy but always productive

- Never emails a quote without a conversation

- Is consistently proactive not reactive

- Remembers to slow down to speed up

- Doesn’t make sales a dirty word

- Is a Tigger and rejects the Eeyore mentality

- Is not intimidated by having a conversation about rate

- Is an educator that uses knowledge as the sword to fight against price

-

Recognizes the honor I have of protecting what people work hard for

First, a Ridiculously Amazing Insurance Agent Outlasts the Suck of Change

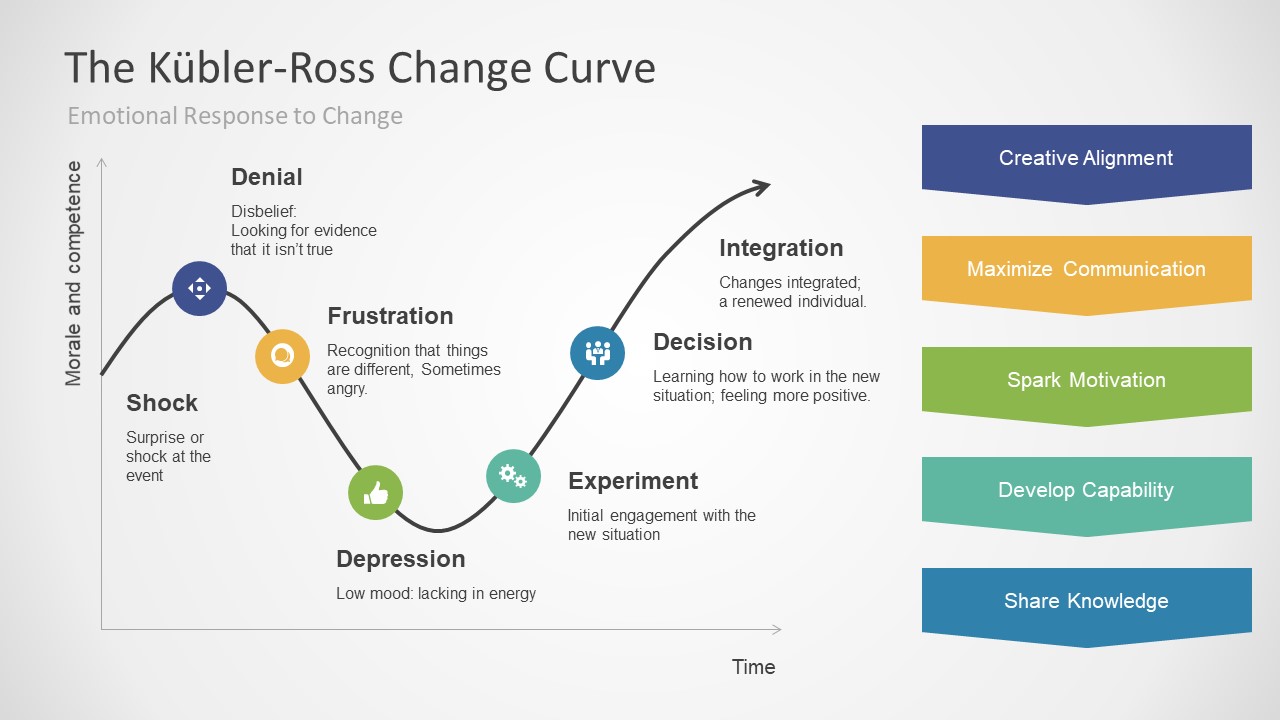

We all know that change is rather difficult, however, it’s also something we have to get better at embracing. Change can make us feel nervous, doubtful and most importantly, can make us lose confidence. Change can be difficult, but there is actually a process to embracing it.

Ridiculously amazing insurance agencies don’t shy away from change. They stick with seeing out all of these steps, even when their peers or community aren’t exactly rooting for them. In many agencies, there will be team members who work to hold back and tear down the efforts to evolve. As leaders, you can work through these challenges by making sure you are:

- Setting a clear vision with details

- Training the team repetitively

- Holding people accountable through metrics, not feelings

When you keep holding people accountable and share the numbers with the team, you can outlast the suck of change.

Enthusiastically Tries

Agency team members can try to show it doesn’t work, or they can enthusiastically try. Trying to fail is making one renewal review call, going into voicemail, claiming no one answers the phone and giving up. Enthusiastically trying is making 10 insurance renewal review calls, fine-tuning your voicemail message, adding in an email template and then seeing how many people call you back. (FYI, on average 50% of people will call you back.)

No matter what, the first 10 times you do anything it will be the worst. Imagine going to the gym. The first few times almost feel dangerous. But once you become used to it, you can adapt and adopt the change. However, if you have insurance agency team members who are not enthusiastically trying, in reality they are trying to show you who’s in charge. In many agencies in fact, the team is waiting for you to give up because they give you such a hard time. You need find out who is not enthusiastically trying and address the situation.

Is Never Busy But Always Productive

When I started working in agencies, I found out that everyone loved telling me how busy they were. Busy, busy, busy. The problem with busy is it’s not a plan, and I haven’t seen anyone attack it and become productive without a whole lot of attention. As a business owner myself, nothing makes me more inquisitive than when someone tells me how busy they are.

What I found in working with agencies is that we are very busy — very busy focusing on the areas that don’t help us grow. For example, a call-in payment takes 15 minutes every month. That is 3 hours per year — PER CUSTOMER! Multiply that by all the call-in or walk-in customers, and you may fall off your chair. But we are often too busy to ask them about other forms of payment, or we like taking payments and chatting with nice people, so we don’t exactly enthusiastically try. Productive agents are proactive and always find the most efficient and effective ways to honor the silent customers who don’t call in 12 times per year.

Never Emails a Quote Without a Conversation

For re-markets or new business, you should never email a quote without speaking to the person first. We all think that people want to see something, but the reality is, if you’re doing it right, you may have a few final underwriting questions, and an emailed quote may can confuse the client. Also, when we send an insured a complicated document like a quote, their brain will tend to focus on what they understand, and that is the price. They make a judgement on the price and decide if they will ever speak to you again OR if they’re going to send the quote you worked hard on to the competition. The value of an independent agent is knowledge and choice. Emailing a quote to someone is a great way to get it off your desk, but all too often leads to unnecessary follow-up and/or questions.

Is Consistently Proactive Not Reactive

If I bought insurance from you 3 years ago over the phone, what is the likelihood that I remember your name and the agency’s name? My renewal comes adorned with the carrier colors and logo. Your name is incredibly small. If I have a referral or another line of business to send to you, do you think it’s easy for me to do that? What happens when my life changes, and I have no idea what to tell you about because I’m not an insurance agent? Do you think the agent being proactive would help?

Making proactive renewal review calls helps you cross sell, reduce re-marketing, increase retention, improve coverage, and it honestly saves time. When we attempt to reach out to every client once a year for a renewal review, we can fairly service every client rather than over-servicing the monthly payers and forgetting about our wonderful pay-in-full clients.

Remembers to Slow Down to Speed Up

Too much time is spent in insurance agencies fixing mistakes. Also, when everyone is too busy, they forget to do the things that actually help you grow — like confirming contact information, asking for a Google review or inquiring about other lines. We all need to slow down to speed up. By slowing down and making sure things are done efficiently but still well, we all win. You have to divorce from the idea that your job is a task — it’s not; it’s an outcome. Then we have to stop speeding through all the work as if it’s a race — it’s not a race! If we want to embrace having a customer experience, it’s the last 10% that really counts. And when you practice this routinely, you will actually save yourself time by solving a ton of little issues that come up frequently.

Doesn’t Make Sales A Dirty Word

I don’t want to sound pushy. I do what the customer asks and that’s it. Calling a current customer for a renewal review is making a cold call. Yes, these are things I hear often in my line of work. Sales can often have a filthy, horrible, dirty feel to it — somewhere around prostitution. But it’s not. If you have ever watched an account manager fight for someone to not reduce coverage, that is the ultimate sale. I want every agent to forget about being a salesperson and turn into an educator. Remember your favorite teacher or coach growing up? They didn’t let you become your own worst enemy. We need to bring that same mentality to our clients by educating them on what they need, allowing them to make a decision for their family.

Is a Tigger & Rejects the Eeyore Mentality

Eeyores are notorious for being sad, not motivated and just downright depressing. Eeyores have no place in an agency. Yes, it’s busy. Yes, people care about rate. Yes, rates are climbing. But talking about it all the time is like describing the water when someone is drowning — it doesn’t get the job done. Complaining about the weather won’t change a thing. Instead, we need to work on retraining our brains to identify all the good work we do and let go of the bad moments. If one out of the 20 calls you made today was hard, you had a 95% success ratio. Eeyore focuses on the 5%, but Tigger focuses on the 95%.

Is Not Intimated By Having a Conversation About Rate

We hate everything about rate changes in insurance. In fact, many of us are scared to talk about rate because we are scared of the client’s reaction. We are uncertain if they will want to stay and doubt anyone can afford insurance. But I’m here to say that is simply not true for ALL customers. Approaching rate with confidence is key. Every agency should have a discount sheet for each carrier. They also need to train their team on re-marketing standards, how to handle rate and overcoming rate objections (hint: break the increase down monthly). At some point I want every independent agent to confidently explain that they are worth more and be able to back up that claim (and you can!).

Is an Educator That Uses Knowledge As the Sword to Fight Against Price

Insurance is complicated, and most people have no idea what they need or what they are paying for. But they have YOU! An uneducated client will always rely on price to make a decision. Mirror moment — who is responsible for educating clients? Hint: it’s YOU. You can educate clients by Turning Every Inbound Call Into Opportunity and making proactive renewal review calls. When you pair this with a sales process, you start educating from day one, and your client can stop judging you on price and instead understand how you protect what they work hard for each and every day.

Finally, a Ridiculously Amazing Insurance Agent Recognizes the Honor They Have of Protecting What People Work Hard For

Each client that comes to you does so because they need protection for what they work hard for. Accidents and mistakes happen, but when they are emotionally and financially crippling, it’s devastating. We aren’t here to do transactions. We are here to protect people, even when we have to have hard conversations. You have the honor of protecting people. We all need to start treating our careers as important as they truly are.

How You Can Become a Ridiculously Amazing Insurance Agent

This is your year because at Agency Performance Partners, we have a plan to help you become a ridiculously amazing insurance agent. We have options to do it yourself and for virtual and in person courses. Start by taking our Agency Performance Quiz To See How You Rate.

hbspt.cta.load(2212084, ‘a5ec851a-c93c-4c2c-b1cc-cf0e88396ae3’, {});

hbspt.cta.load(2212084, ‘a5ec851a-c93c-4c2c-b1cc-cf0e88396ae3’, {});