One of the most common obstacles I hear to selling insurance is hearing people say things like “I’m not in sales” or “I’m not a salesperson.” Almost every service person I have ever met wants to put the client’s best interests at the forefront. I completely agree with this approach. A client-focused approach is the best way to create scenarios where everyone wins.

The conflict I find is most often with the service rep not feeling comfortable about discussing increases in coverage or additional policies, even when we know it is in the client’s best interests to have this protection. My definition of Good Service is providing the client with what they need, not what they ask for (sorry for the ending my sentence in a preposition!). The general public is not aware of their risks, the solutions, or that we have the solutions.

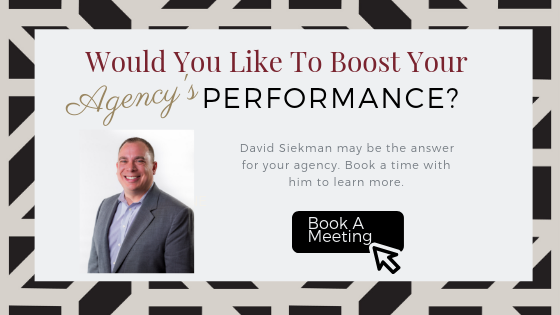

This has been a discussion for my entire career. Everyone can wrap their head around the concept, but taking action can be difficult. Our two biggest training programs (AppX Retention and AppX Sales) have components assisting in the improvement of sales skills for both salespeople and service people. The common issue with both programs is not typically a feeling like we are doing something wrong by the client, but a fear of coming off too salesy, which typically creates an uncomfortable conversation and an awkward experience.

For a few years now, I have been adjusting some of the terms I use to help increase the comfort level and decrease the awkwardness around the discussion. Getting the heart to believe what the head knows can be a long process.

Here are four terms commonly used in our industry which should be adjusted when thinking about the approach with the client. I am in no way suggesting these are negative terms and should be completely eliminated from our lexicon and more importantly, our key performance metrics, but only that they can sometimes hold us back from doing what is best for our clients.

The term to the right puts the client experience in front of the agency goals, creating a situation where it becomes more comfortable for those with less inherent sales skills to approach the client about improving their protection.

| Upselling | —> | Increasing Coverage |

| Cross-selling | —> | Account Rounding |

| Sales | —> | Education |

| Retention | —> | Relationships |

In all of the cases above, the traditional term (on the left) is a very agency-focused term. In three of the cases, we also use the word “sales” or “selling.” The beneficiary of these terms is the agency. While I am all for us selling, upselling, and cross-selling, these terms appear to put the agency before the client. Even the word “retention” is basically us holding onto a client versus the client deciding we are the best agency for them.

Upselling a client does not always have the client’s best interests at heart. I remember buying our last car and finding out it didn’t come with floor mats, but for an extra $1,000, we could get them. A quick Google search showed me I could buy ones to fit for 20% of the cost. I mentioned this to the salesman, and he told me how they wouldn’t fit exactly and I was better off with the official ones from the dealer. This really rubbed me the wrong way and almost caused me to back out of the deal. I ended up making the car purchase but passed on the floor mats. When I think about upselling, I think about this situation, and I understand why someone with a conscience would hesitate to upsell.

Let’s apply this to an insurance situation. If I have a client with $100,000 of Property Damage and I show him or her how to increase this to $250,000 for less than a dollar a month (in most states), am I upselling in the traditional/negative connotation of the word, or am I increasing their coverage (and protection)?

Cross-selling is very similar. How often have you heard something like, “I didn’t realize you sold homeowners” or “I didn’t know you provide business insurance”? When a client is unaware of our products, it is our fault. We must let them know about our products and their value. We all know the vast majority of clients are best off having all of their insurance with one agency. By rounding the account, we are ensuring proper protection, eliminating potential gaps in coverage, getting the best rate, and making it more convenient for the client.

Both upselling and cross-selling (increasing coverage and account rounding) fall into the larger bucket of sales. Generally people with more of a service focus want to avoid being salesy at the expense of hurting an existing relationship and potentially losing a client. Instead of trying to sell new policies to prospects or clients, we simply need to make sure we are educating them. We need to educate them on their risks, where they are currently exposed, the solutions to those exposures, and our ability to provide the solution.

Again, the difference between the approach of selling and educating clients is minor. In order to be able to sell the client anything, they need to be aware of the problem and the solution. The first step in sales (or the approach) is to provide that education. There are certainly higher level steps to be made to close sales, such as how to present the quote or ask for the business, but it all starts with education.

Finally, the word retention doesn’t have the same negative connotation as the word sales, but I still believe it can be too agency-focused for some service people. While everyone hates to lose a client, simply saying we want to retain clients doesn’t provide us with an approach to doing so; the word relationship does provide an approach. This is what most account managers have been doing for years. The better the relationship with the client, the more likely they are to stay with us. We should absolutely be looking at our retention rate as one of our major metrics, but to improve it we should be focusing on how we improve our relationships with our clients.

Ultimately, we should have at least one goal around each one of these items. But creating a goal is not enough! Identifying the metric and creating a goal is the easy part. The difficulty is building the path for success and being able to achieve the goal. Our approach at Agency Performance Partners is to not only provide scripts, reports, workbooks, goals, etc., but to work directly with the staff to achieve success. Changing the vocabulary to change the approach is certainly one component of helping to achieve success.