Introduction

When you own and operate an independent insurance agency, growth is always on your mind. It may even be what you obsess about. Let’s be honest, growing is fun! However, with growth can come growing pains. As a leader, it is up to you to navigate those growing pains.

In fact, as a leader, it is your responsibility to proactively find challenges and solve them for your team. When we see agencies get stuck and stay stagnant, it’s usually because the challenges are equal to the opportunities. An agency divided between challenges and opportunities will always get stuck.

In this blog, we want to outline for you an exact strategy on how you can address the common pain points associated with insurance agency growth.

All too often we see heavy insurance agent incentives for new business and unfortunately, the agency is still shrinking. The team is focused on new sales because that is what the agency, their compensation, and the agency owner’s attention are. However, you cannot sell a policy to lose one. For that reason, we have identified 8 Ways to Make Money in an Agency:

- New Business

- Retention Rate

- Coverage Improvements

- Cross-Selling

- Placing Business

- Firing Your Unprofitable Customers

- Effective Budgeting for Profit Margin

- Fees

Your agency needs a strategy for each one of these areas. For this blog, however, we are going to focus on the infrastructure you need to grow your insurance agency. This blog isn’t for the agency looking for the sexy, get-rich tip. This is the hard work that you need to do to build a strong infrastructure that will weather growing pains.

Here are the six key pillars your agency needs to grow:

- 10-Year Vision: It’s impossible for your biggest expense (your team’s payroll) to be efficiently helping to grow your insurance agency without a clear vision. Agencies without vision have no target other than a temporary goal. Vision, when done right, allows everyone to understand where you are going, what is in it for them, and the “why” behind key agency decisions.

- Values: Oftentimes, the gray area in agencies is where too much time is wasted. Values are the norms by which the insurance agency team operates. It’s more than a job description or a process—values are the tissue that connects everything and allows you, the leader, to address substandard behavior (not work product, but behavior).

- Job Descriptions: Almost every agency we walk into, the team wants clarity. They want to know what their role is and what they are responsible for. The challenge is, in a small business, it’s not always that neat. All too often, without a clear job description, people create their own way of doing things based on their own preference. Twenty ways of doing something is no way to grow your insurance agency.

- Training & Strategy: Hope cannot be your team’s strategy. When you set your insurance agency growth goal, it is on you, the leader, to build a plan, train on the plan, and assess its success. Agencies lean too heavily on hope as the growth plan. We prefer a more calculated approach.

- Transparent Reporting: Too many agencies start running on feelings, and this trips up growth. As an agency starts out, new business is the metric to track. But if you are running your agency correctly, this number switches to needing to tend to the current customers, as this is where your growth can churn.

- Communication: As agencies grow, there must be clear and defined leadership roles. Leaders can help communicate what is working and what is not, and be a coach on the field.

Let’s review the ways to grow an insurance agency by focusing on the right things.

Looking to see the top 10 agency challenges?

Download our complimentary guide on the top challenges we see and how to fix them:

APP Update Section

Travel Dates (Week Before the Post):

Kelly: Chico, California

Heath:

Stephen: N/A

Agency Win:

Lesson of the Month: It’s always easier to have a difficult conversation than to avoid it. Take a few moments of awkward (but honest) communication over becoming passive-aggressive.

Professional Goal Update:

Personal Goal Update:

Current Obsession: Full Focus Planner. Yes, it’s paper, but it has kept me organized for over two years now! I prep my day with it and end my day with it—but I never do more than that, it’s not on my to-do list. It’s my way of identifying my frog.

10-Year Insurance Agency Vision

If you are like many insurance agency owners, you may be putting off creating your agency’s vision because it can be a bit (if not totally) overwhelming. Here are the top reasons we see agency owners struggle to craft their vision:

- They are unclear on what they want

- It feels very vulnerable to be bold and put a big number out there

- You think by creating a vision, you may be missing opportunities that aren’t part of your vision

- You aren’t very clear where to start

These are all common concerns, in fact, I personally have had all of them. However, as your business grows, the role of the leader is to communicate to the team and be a good steward of resources. Without a clearly written vision, the team cannot put their energy toward a target—they will operate doing what they feel is best. Without a vision, you may lack clarity on where to invest your agency resources, thus spending time and money going in the wrong direction.

You may also be asking, “Why 10 years? Why not three or five?” The answer to this is simple. With 10 years, you can go into dream mode for what you actually want. Anything less than 10 years, you think of obstacles and challenges and don’t dare to dream nearly big enough.

How to Create Your 10-Year Vision

It may be helpful to establish a starting point for crafting your 10-year vision.

- Think about your personal life first. How old will you be? How old will your kids be? In 10 years, what do you want your personal life to look like? What assets would you like to have? How much do you want to work?

- In order to honor your personal vision, what income level do you need to be at? How much time do you want to spend working?

- What revenue does the agency need to be at to get you what you desire?

- Now you can break that down to an annual target.

- Identify a key investment the agency will need to make each year to make that happen.

Hopefully, this is a good starting point for you to identify your 10-year vision.

10-Year Vision Best Practices

Once you have a clear 10-year vision written down, we want to share with you how to take it from a wish to reality:

- You can update and tweak it every year

- Have a launch party with your vision

- Have posters and flyers made

- Make the vision part of your monthly meetings

- Update agents on the big investment every year that will help fuel the vision

- Be clear on what is in it for every team member when the vision is realized

Insurance Agency Values

Not sure why you need to invest your time into building and clarifying your insurance agency values? Take three minutes and watch this video all about what values solve for your agency.

Simply put, values help you hold people accountable to not being jerkfaces at work. In addition, values help the team make gametime decisions without needing a supervisor. The values are the guiding principles for everything that can’t be covered in job descriptions, codes of conduct, or processes. Simply put, it’s how to be a good citizen of your insurance agency.

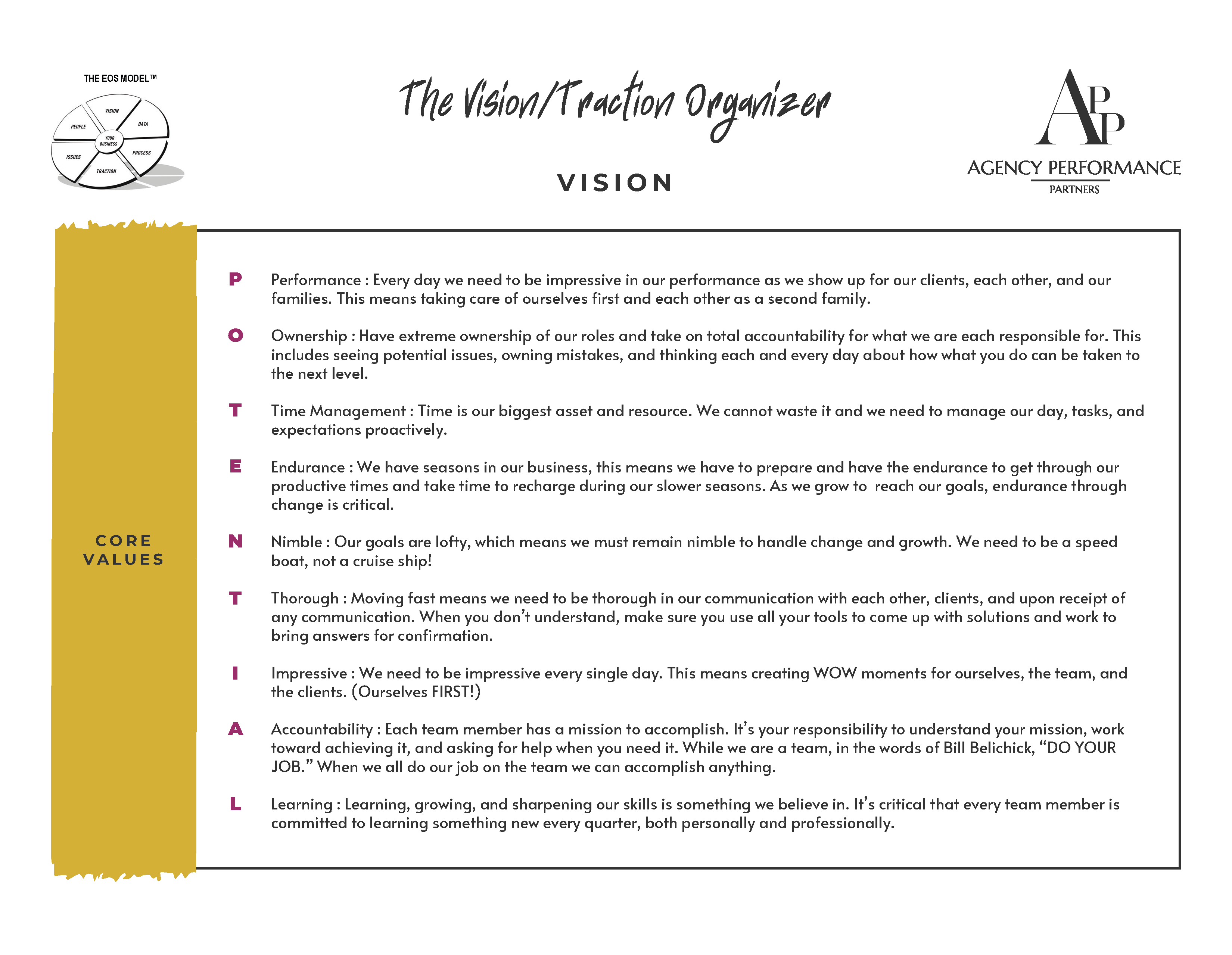

Without values, your agency will struggle to address interpersonal drama that is taking up way too much time. In order to get started on values, allow us to share with you our values at APP:

How to Create Insurance Agency Values

How to Create Insurance Agency Values

When we are hired to conduct our agency assessment, one of the outputs is always developing agency values. We start with a word that resonates with the leadership team. For me, as the leader of APP, it has always been potential. That’s what we want to realize for ourselves and our clients!

Once you have your word, it’s a few quick Google searches to find values that associate with the word. We also suggest to agencies that you identify a list of the major problems you see in the agency. It could be attitude, work ethic, or how team members treat each other. Then you can look for words that support the behavior you want to encourage in your agency.

How to Roll Out Agency Values

Values are only good if they are adopted. Here is a quick checklist of what you need to do to get your agency values in place:

- Create posters and flyers. Work with a graphic designer to make them nice!

- Have a launch party—not a meeting.

- Do a workshop about how we support or trash these values.

- Have an award for when someone displays these values.

- Add them to job descriptions and review forms.

One note, it is critical that everyone on the leadership team display these values. People will be watching. If you can get everyone on the team honoring your values, you will clear out several obstacles to true growth.

Job Descriptions

As agencies grow, roles change. In fact, for many agencies, hiring has been such a challenge that agencies are finally scaling and organizing around licensed and non-licensed work. Everyone deserves to know what their role is on the team, what they are being evaluated on, and how to win.

The challenge we see in too many agencies is that job descriptions are old, outdated, and/or rarely even reviewed. It’s a piece of paper, not a directive. Without current job descriptions, everyone makes up their own role, and well, the natives start getting restless! You can easily see how growth can be more difficult when everyone is making up their own priorities.

If you hear the following in your agency, you need insurance agency job descriptions:

- “That’s not my job”

- “My customers want it this way”

- “My customers only want to talk to me”

- “It’s just easier to do it myself”

- “I don’t like the way XYZ does something”

So if you hear these items you have a job description and a culture problem (and probably we need to talk about our Agency Assessment).

How to Create a Job Description

Our job descriptions have a few key areas:

- Mission of the role: Why this role exists.

- Job Descriptions: This is metrically based and can be turned into a review form. These are clear deliverables, not fluffy things like answering the phone. There needs to be more detail: Pick up phone calls by the second ring.

- Key Performance Indicators: Every role needs two to three metrics so you can evaluate their performance and they know how to win. In our Job Description Performance Pack , we have 12 job descriptions all with metrics pre-built for you!

- Values: Yes! We add the values right in the job description!

- Evaluations: Reviews and evaluations are critical, it should be stated on the job description what to expect for reviews.

If you need help, don’t recreate the wheel! Get 20 percent off the 12 Agency Job Description Process Pack. Let us help you get your insurance agency team updated with accurate job descriptions.

Training and Strategy for Insurance Agency Growth

Hope is not a strategy. When you set your agency vision, it is critical that you don’t just show your vision. You must also share your strategy. Your team needs leadership and guidance. If the vision is to have a 95 percent retention rate, or grow to X in revenue, you and your leadership team need to identify a specific plan of attack.

Think about it this way, in football, the receiver isn’t in charge of calling the play or designing the play—he is simply in charge of running the play. Your agency needs to handle the following to be successful at growth:

- Build the strategy

- Train the team

- Hold them accountable

You may be struggling, thinking about how to build the strategy. I can tell you personally, on our blog, we have over 700 pieces of content to help you. This is something that you can do yourself, but you may be questioning if it is worth your time.

How to Make Training Work in an Insurance Agency

As a trainer, I know people hate insurance training. When I first walk into a new agency, it’s not all hugs and kisses. Mainly, it’s “Why am I here and what am I going to learn from her?” I’ve stopped taking it personally. But, with the right approach, training can be fun and break through people’s barriers to success.

Here are some great options for training your team:

- YouTube: There is a video for everything! You can check out our channel here! Need a video for something you don’t see? Just ask and we will whip one up!

- Carrier Training: Grab the popcorn and get in the conference room for some carrier training.

- Online Courses: There are several online courses that will help your team succeed. In our online school, we recommend that you subscribe, and during each team meeting, watch one video in the course together to discuss and create a plan. Our courses come with workbooks for the leader and the student to make sure your team can take action. We have courses on sales, retention, handling rate, time management, and more.

- Virtual: If you need more, consider working with a virtual training, live via Zoom!

- Live: Want the full experience of having a trainer come to you? This is the fastest way to drive a result!

“Your team is your biggest agency expense. Not having continuous training in place is letting your biggest asset go without attention.”

Transparent Insurance Agency Reporting

If there is one thing I wish I could banish from every insurance agency, it’s feelings. There are so many feelings in the average insurance agency—but remember, people—feelings don’t have brains. We are operating agencies on the whim of the day rather than cold hard facts.

Now, it took me a while to trust agency metrics. Getting accurate reporting out of most systems is about as easy as trigonometry, but somehow I passed that in high school. Your agency must commit to getting reporting right so you can clearly see what is happening, what needs to happen, and share with the team transparent numbers.

This happens all the time. People feel like they are working so hard, they are exhausted. But, when we run the numbers, the book is shrinking. So we are killing ourselves to shrink. Light bulb moment right here.

Reasons Your Insurance Agency Management System Reports Are Wrong

Generally, your reports are wrong because of one or a combination of all of these things:

- Download

- Data Entry

- Report Setup

- Confusion on What is Being Measured

When you see a report, and you know it’s wrong, it makes you want to give up and you surely do not trust that report. It’s easier to go sell a policy than fix it, but that’s the wrong approach. Instead, you need to buckle down and get down to business with understanding your reporting.

How to Share Insurance Agency Reports With the Team

At first, I was reluctant to share our agency metrics with managers and staff. Fortunately, It’s been one of the best decisions we have made. Staff members from processing to management now work to achieve goals, stay current with their activities, and are working better together as teams. Everyone strives to watch the quarterly bonus pools increase and get excited when it’s time to reap the reward. We have worked as a team to clean up data and make sure all new data is inputted properly and trackable.

Cindy Winn, Widener Insurance

After getting your insurance agency reports reasonably accurate, the next step is sharing them with the team. We recommend only sharing three metrics to start with. Something simple and easy to digest. Don’t expect everyone to be excited, reports mean accountability.

Allow the team to ask questions, they will have them!

Make sure you share the numbers every week with the team. It may take a few weeks, but they will catch on.

Also, don’t be scared to show them the numbers. If you are showing a leaderboard or overdue activities, the numbers are what they are. When you hide certain numbers, it can lead to more descent. Be open and transparent, those who are not performing may step up their game when shown their actual performance.

(Tip: Watch for a future blog on August 8, 2022 on which reports your agency needs to be running!)

Clear Communication in an Insurance Agency

We have surveyed almost 2,000 agents as part of our agency assessment program. Communication is still one of the top three areas for improvement. Don’t we want better communication in general? I want better communication with my team, husband, and family. We all crave communication, but in general, we are horrible at it. Agencies often do not have a clear communication strategy and staff members often take communication too casually. So how can we all communicate efficiently and effectively?

It has been said that an adult needs to hear the same thing 22 times to remember it. As an organization, we need to stop emailing out communication and expecting everyone to automatically get it.

Insurance Agency Meetings

Effective meetings are a great way to communicate with the team. Here are the meetings we generally recommend for agencies (watch for our blog on August 22, 2022 on how to have an effective insurance agency meeting):

- Daily Good Things Huddle: Start the day right! Everyone stands up (no sitting, this is a quick meeting) and shares one positive thing from the day before.

- Weekly Team Meeting: This has an agenda, starts on time, and is meant to review metrics, find obstacles, and conduct 10-15 minutes of training.

- All-Hands Monthly Meeting: Get everyone together for a monthly meeting to review the vision, values, goals, and metrics, and provide recognition. Share your strategy for the next month.

- Quarterly Off-Site: Shut down for a ½-day quarterly and go off site. Have a speaker come out (we love these types of events at APP) and combine insurance training and an agency update.

- 1:1 Meetings: Workday suggests making time for one-on-one meetings. When they are scheduled, they aren’t as intimidating, and you will learn a lot about what is really happening.

Another great tip is from The New York Times. Always leave every meeting with a clearly documented and distributed action plan. We love this! The team can be engaged in the meeting rather than focusing on their to-do list (or doodling).

Types of Communication

As a rapidly growing company, we change things a lot—so much so you may get whiplash. We identified a communication strategy for changes that has helped us a ton:

Direct and Indirect Updates

- Every communication update will include the people who the update directly and indirectly impacts

- Direct: This impacts your day-to-day job and you need to understand it and execute

- Indirect: This impacts the APP team and clients—you need to be aware of it but it does not directly impact your role

Levels of Communication

| Explanation | Methods of Communication | |

| Tier One | This is a big change in how we do things and operate. There will be a date to release to the team and a date the change takes effect.

Example: Updated brand guide, Move to Hubspot payments and ACH. |

|

| Tier Two | This is an update to a current process or procedure.

Example: Identifying data roles, Moving from having Michelle get email count updates from clients to automating it in Hubspot. |

|

| Tier Three | This is a tip or trick. Something small that it’s nice for people to know. It’s not a change but an enhancement.

Example: How to categorize a company in Hubspot with different company names, Hubspot or tech vendor updates, reminders on who has a Survey Monkey login. |

|

Conclusion:

As you grow, your insurance agency will need more structure. Remember, your agency’s biggest investment is your team. If you invest in your team and provide them with structure, solutions, tools, and a plan—your agency will grow. If any of these break down, your agency will spend more time putting out fires than growing.

Listen to Heath and Kelly Banter on this Topic

Interested in Our Agency Assessment?

Let us assess your agency and partner with you on executing a game plan to overcome your agency’s biggest challenges. The assessment includes:

- Secret Shopper Calls

- Agency Reporting Dashboards (yes, we will help you get the data right!)

- Team Survey

- Team Interviews

- Leadership Planning Day

- Job Descriptions

- Incentive Plans

- Values

- Vision

- Agency 2.0 launch meeting to share plan

- And more, give your agency the structure it needs to succeed!