Running An Insurance Agency:

Top 6 Things

You Need to Know

RUNNING AN INSURANCE AGENCY

Welcome

How Much Does Culture Matter In Your Insurance Agency?

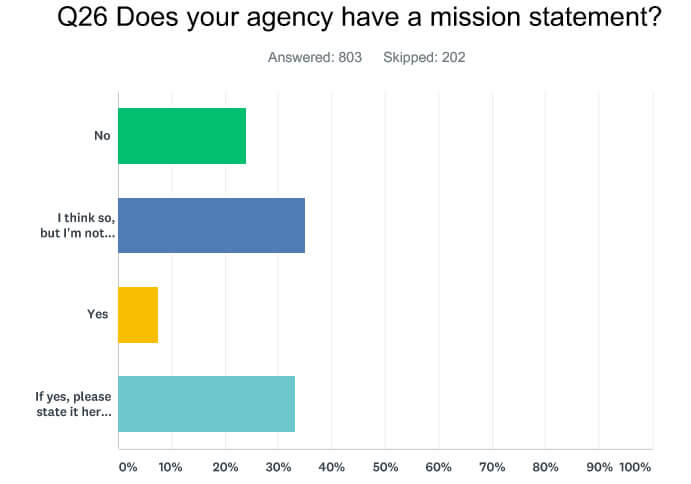

Does your agency have a mission statement?

On a scale from 1 to 5, how much do you like the customers of the agency?

& When it comes to agency values, do you believe everyone shares the same values?

If you can describe your agency culture in three words, what would they be?

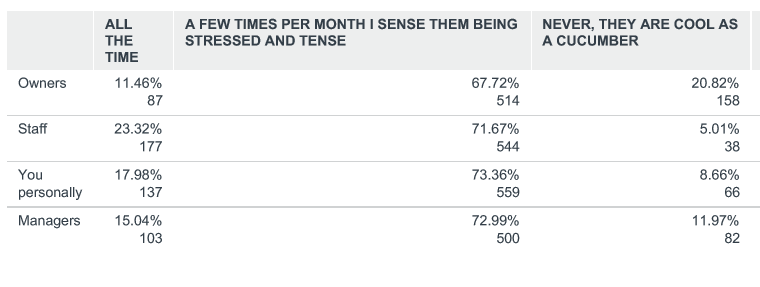

In your opinion, how often are you, your co-workers, managers and owners stressed or tense?

Do you feel you are part of something special by being part of this agency?

Is there a negative influence in the agency?

It All Starts With Strong Insurance Agency Leadership

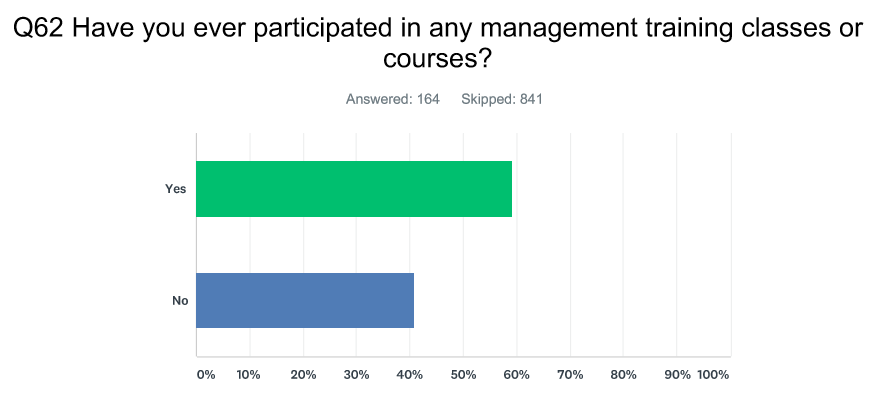

All Effective Leaders Are Learners

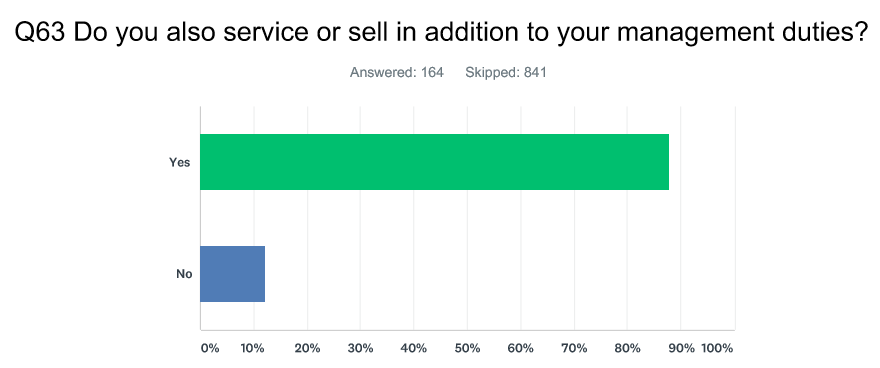

The Leader Can’t Do It All (and shouldn’t try to)

Communicate Often and with Purpose

Does Your Team Know What They Should Be Doing?

Money Isn’t the Only Motivator

Commit to Constant Improvement

Prospects Can’t Buy From You If They Don’t Know You Exist: Why Marketing Matters

Outsourcing Marketing Is Still On Top

Email Marketing Is Still Slow to Be Adopted

Blogging Shows Google Love

Only 31% of Agencies Have Set Marketing Goals

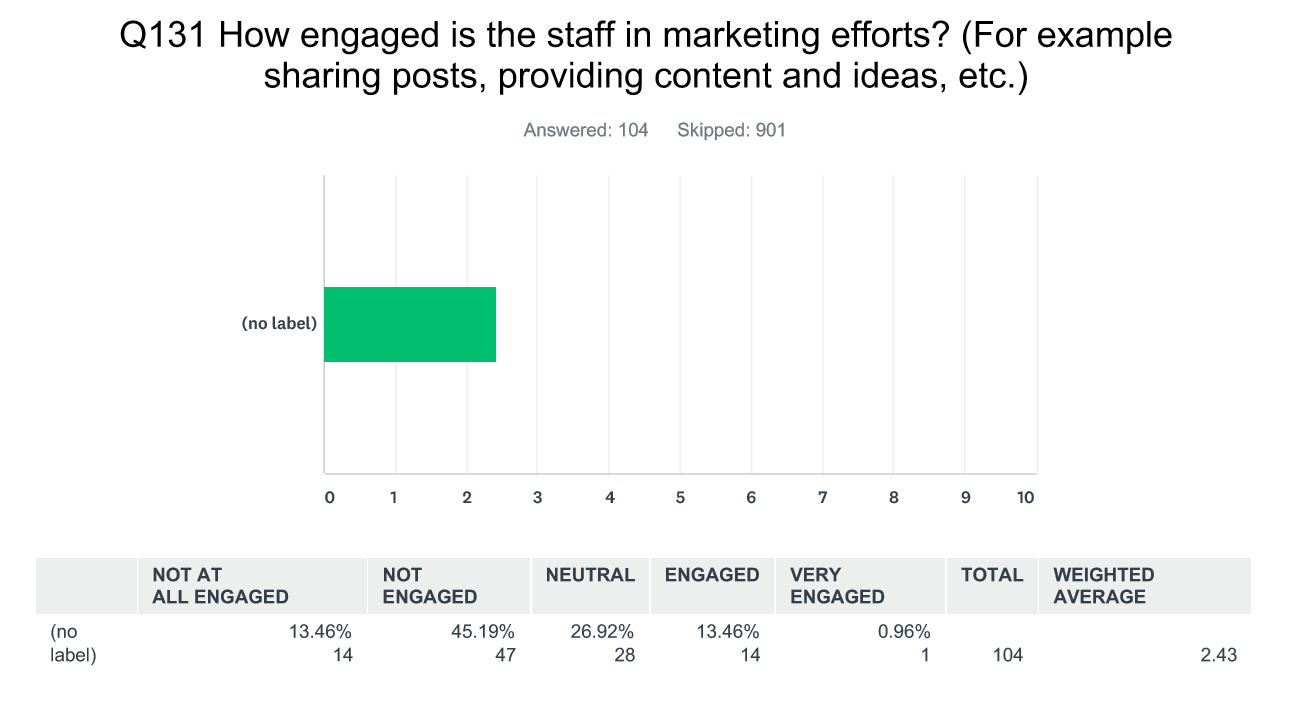

Most Agency Staff Do Not Engage in Marketing

Shhhhhh Insurance Service Is Also A Sales Role

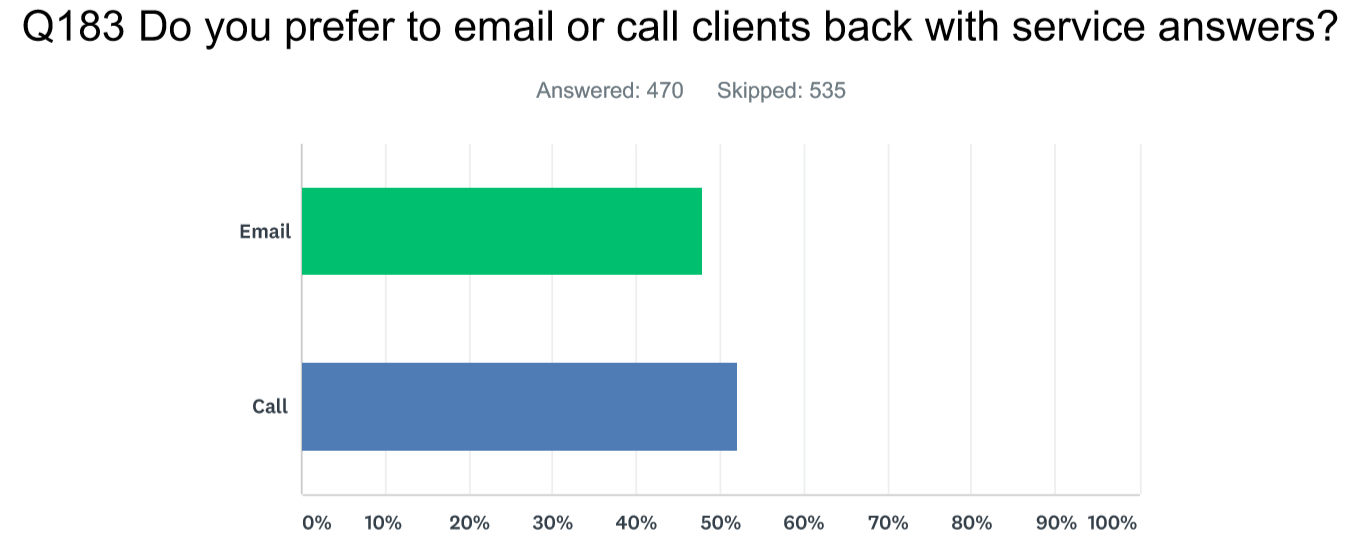

The Power of Service to Drive Growth by Connecting with Your Clients

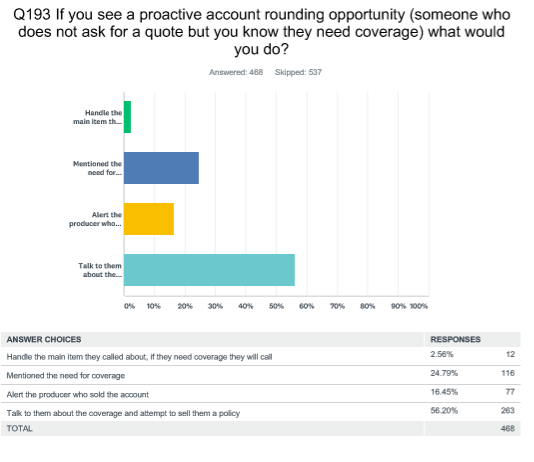

The Power of Service to Drive Growth Through Sales

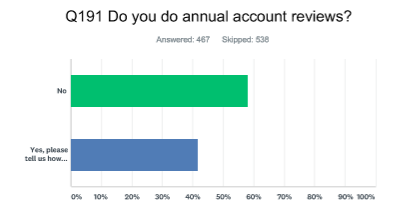

The Power of Service to Drive Growth Through Improved Retention

Insurance Sales Starts With Training

51% of sales agents have had no sales training

Asking for referrals is the lowest skill set for Producers

79% of sales agents say their closing ratio is not tracked

What’s Next?

Sharing Is Caring

Lean On Facts, Not Feelings

You Are Not Alone

Welcome

It’s hard to believe, but more than 5 years ago I left my well-paying job to strike out on my own, and well, the Agency Assessment was the first ever service offering that I developed. Now, in under 5 years, we have 1000 agency team members that have participated in the Agency Assessment.

An Agency Assessment is a physical for your agency! We go through every nook and cranny and then compare your results to your peer group, so we can quickly identify your strengths and areas for improvement. We don’t leave you there; we partner with you for 90 days (and often many more months!) to help you execute your strategy. It’s like having a business partner who works hard for you, but doesn’t require equity or a company car. Based on this assessment we have developed the top 6 areas your agency needs to embrace.

how much does culture matter

IN YOUR INSURANCE AGENCY?

One of the hardest areas to address in an agency is Culture. It can be hard to define and even harder to adjust. We often find many of the items identified in the assessment to be resolved have a tie-in to culture. By the same token, many things executed properly in the agency are a result of the culture as well.

Our dive into the culture components of our Agency Assessment will take a look at how we identify the current culture and how it negatively and positively affects the agency. We can then address ways to improve the agency culture. We have a number of questions within the Agency Assessment aimed at helping us and the owner and upper management identify the current culture. Most times the owner and managers have a pretty good feel for their agency culture, but there are often specific aspects that arise. Some of our culture is defined by our own approach while other aspects are defined by co-workers, clients and ownership or management.

Here are a few sample questions asked in the online survey to help us identify and define the culture.

A good mission statement is not just a high level statement put together as a checklist item for a business owner. A good mission statement is known and understood by the staff and is used on a daily basis to drive decision making around handling clients or creating a process. A good mission statement ensures everyone is headed in the same direction and eliminates conflict between employees and departments.

A lack of a mission statement (or a lack of the staff knowing it and understanding it) creates a culture with a lack of vision and inspiration. Mission statements are a little easier to write than they are to fully implement within an agency; however, writing one is the first step. Once it is written, discussions around the mission during your weekly meetings to get people to understand it is critical. Whenever a decision needs to be made when it comes to handling a client, or building a system or process, the decision must align with the mission statement.

& When it comes to agency values, do you believe everyone shares the same values?

These two questions are probably the most valuable to me when I am trying to understand an agency culture. While I’m not expecting 5s across the board, when I see all 1s and 2s, I immediately start to think about a more negative agency culture. Typically this means there is a lack of understanding about how we are all in business. I am not saying the customer is always right, but without them, we are out of business! Lower numbers here also show the employees are probably at odds on many topics. When I see 4s and 5s in this category, I’m feeling pretty confident the employees understand they are in control of their approach. They are thankful for their clients and appreciative of their co-workers. While we all know clients can be difficult, these employees are typically more empathetic and understanding of the clients’ circumstances. It also generally means they feel they can lean on each other when necessary whether they are going to be out or just need assistance with a difficult issue.

This is probably the most direct question we have regarding culture. If I get positive answers from all participants for all three or if I get all negative answers, I know what type of culture I am going to see. Typically I’ll see a positive in the first or second answer and then a negative in the second or third. These answers are actually very valuable when looking at an agency. It helps to know both the agency’s strengths and weaknesses. Usually this response will help drive changes in procedures if people feel like things are not organized or consistent.

This question gives me the most insight into the perception of the managers and owners. Culture starts at the top, and typically how employees perceive the approach of the managers and owners to stress will partially drive the employees’ approach and attitude. It is key to note that perception equals reality here. Often the owners or managers will be surprised by the responses here. Typically we find the staff wants to see their leaders calm and composed, and any type of venting or complaining, even when it’s meant to be collaborative, reduces confidence in the leader. This can easily be solved either by reducing or eliminating the need to vent or complain, or by finding another outlet (friend, spouse, other agency owner) with whom to have the discussion. Allow your staff to hold you to a higher bar.

The responses to this question usually line up with the responses to the questions above. The staff can help build an amazing or terrible culture based on their belief of the direction of the agency. People all want to feel like they are contributing to something special and will work harder and with a better attitude when they believe this to be true. Unfortunately, work ethic and attitude often are worse when people don’t believe they are part of something special. Turning this thought process around can be difficult. It is not something that can change overnight; rather it’s implementing the appropriate change to get the agency back on track.

When the answer to this question is “yes”, it is typically the one remembered when I meet with people in their one-on-one meetings we have as part of the Agency Assessment. It very often becomes part of a staffing discussion around whether or not we have the right people in the right positions. Most often when there is a negative influence, it is well known. Other times it comes as a surprise to the agency leadership. This may be the most important component in discussing agency culture because one negative influence can throw off the entire culture. We often need to be honest with ourselves about whether the individual can be turned around. It may come down to an ultimatum for someone to either change/improve or for them to move on.

There are many ways to change around the agency culture or to continue to improve it. The key is finding the right areas to change and to make sure everyone is on the same page. Forcing any changes onto a staff already struggling with culture can make things worse. If we do have a positive culture, it is typically easier to shift the focus. For example, if you know you need to create more of a sales culture, with a positive culture in place, this shift is much easier than if you have negative influences. If you have negative influences, you need to determine how to solve that issue before you can start to shift the focus of the agency.

it all starts with

STRONG INSURANCE AGENCY LEADERSHIP

We’ve all heard it said that everything rises or falls on leadership. If you are the leader of your agency, you are responsible for casting and pursuing the vision, goals, strategies, skill training efforts and accountability measures needed to relentlessly pursue agency health and growth.

If this sounds like a daunting task, it is! After all, many people are counting on you — your clients, employees and their families.

Let’s look at some informative observations compiled from leaders and the staff they lead that will help you to pursue more effective leadership in your agency today.

This is one of my favorite immutable truths of leadership. The moment you stop learning, your ability to lead declines. How can a leader possibly have all the answers related to agency vision intuitively without investing in a continued process of learning? Being a great salesperson who built an agency from scratch doesn’t translate to automatically knowing how to effectively manage, motivate and empower a team. Our agency assessment data reveals that only 59% of leaders have participated in management training courses. Are you in the 59% or the 41%? The Peter principle concept of management developed by Laurence J. Peter in 1968 observed that people in a hierarchy tend to rise to their level of incompetence.

The observation is that people who perform well at one level are promoted to a higher level of responsibility and eventually can find themselves overcome by the demands of the new position. As you consider the growing demands of leadership, don’t assume you can handle it with your own raw talent and determination. Remember to invest in your own personal professional growth and consider a performance training day for you and your leadership.

Do you have a tendency to want to wear all the hats or micromanage your team? If you’re an agency owner, are you delegating effectively to your managers? If you’re an agency manager, are you giving opportunities for growth in responsibility to those proving they can handle more and are looking for it? Eighty-eight percent of leaders have shared with Agency Performance Partners that they sell, service and manage. While it’s valuable to keep your finger on the pulse of your agency and know how to sell and service like everyone else on the team, are you giving adequate time to pursuing the larger goals of agency growth through effective leadership? Perhaps you need to trust your team more to take on some of the responsibilities you’re still hanging onto? You can find yourself so busy working IN the details of your business, you don’t have time to work ON the larger leadership responsibilities of your business. It was Theodore Roosevelt who said, “the best leader is the one who has sense enough to pick good people to do what he or she wants done, and the self-restraint to keep from meddling with them while they do it.”

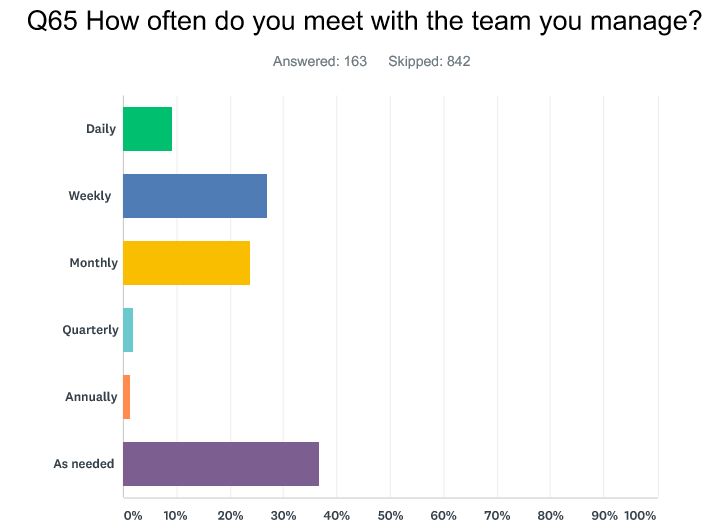

We all love meetings, right?! The truth is we dislike wasting our time in ineffective meetings that lack real, meaningful communication and connection. Sixty-four percent of leaders who responded to our Agency Assessments shared that they meet with their entire team monthly, quarterly, annually or as needed. Thirty-seven percent of that total meet “as needed,” most likely indicating that there is no plan for regular communication until there is a problem. Fifty-seven percent shared that they meet “as needed” one-to-one with those they directly manage.

This lack of planned communication will limit your progress since vision, goal setting and strategizing can’t occur “as needed.” Commit to regular meeting times with meaningful agendas. Instead of avoiding meetings until something needs fixing, try communicating more frequently with regularity to tackle problems, new initiatives, and even training your team in smaller, more frequent segments. For example, after the onsite portion of our Agency Assessment concludes with a plan to execute strategies over the next 90 days, our Performance Consultants meet bi-weekly with each agency to help drive initiatives, measure results and hold your team accountable to the actions needed to drive agency improvement.

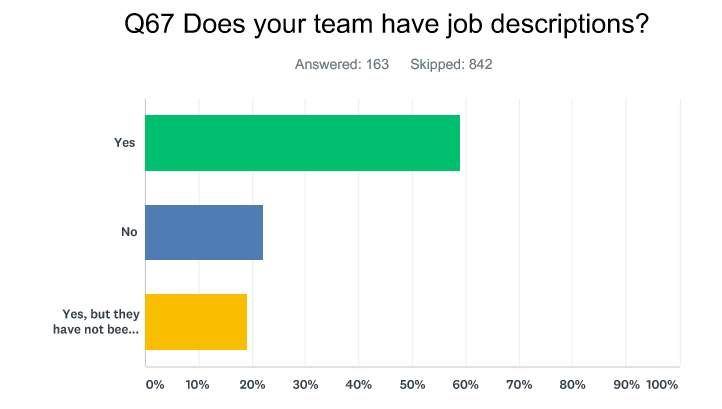

Data gleaned from our Agency Assessments reveals that 22% of employees have no job description at all while 59% have a job description that hasn’t been updated in the past five years. In addition, 46% of staff do not have annual reviews. The importance of providing to each employee a clear, written job description that is aligned with agency goals can’t be overstated. How else will they know what they should be doing? Reviewing job descriptions annually provides a basis for performance reviews and also allows for needed changes to be discussed and embraced as the needs and roles of each agency necessarily change over time.

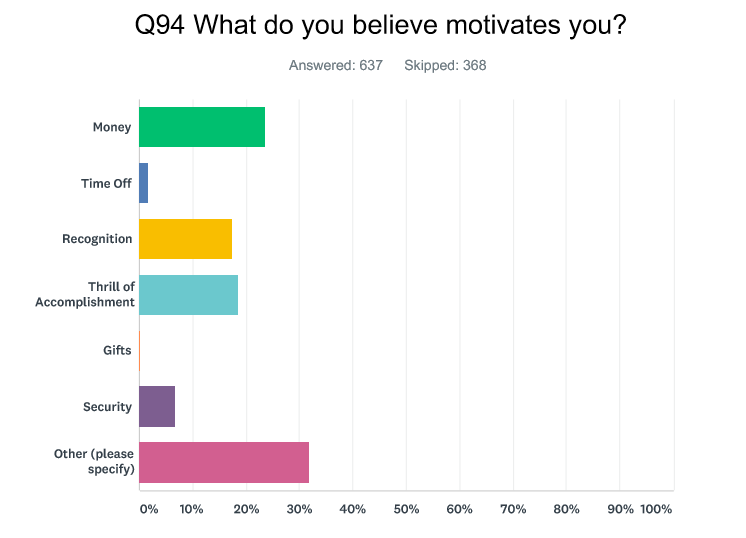

Interestingly, most agency leaders think that money is the prime motivator for their team. While it is of prime importance, a combination of factors trumps cold, hard cash. Recognition and the thrill of accomplishment are actually a greater combined motivator overall at 36%. Recognize that money isn’t the only thing driving your team to succeed. Words and actions that recognize exemplary effort as well as allowing your team the autonomy to experience the thrill of victory can greatly improve their satisfaction in the workplace.

While carrier and insurance guideline topics are often a part of agency training, there must be additional aspects of agency improvement pursued through training and coaching. Seventy-nine percent shared that there is no continuous training program in their agency. The problem is that attending a motivational class at a conference or emailing your team a training topic video is not enough for real, lasting impact. Engaging in a six month program of sales training with Agency Performance Partners, for example, consists of onsite 1:1 training, bi-weekly metrics to show results, scripts, role playing and bi-weekly coaching calls as a practical strategy to drive lasting change. Invest in consistent and constant improvement to build your team effectively one day, one week, one month at a time.

prospects can't buy from you

IF THEY DONT KNOW YOU EXIST: WHY MARKETING MATTERS

I get it, you have your insurance license, not a marketing degree, and in today’s world you need both. Many agencies are still aggressively waiting for the phone to ring, and they haven’t tapped into social media, database marketing, blogging and more. Too many agents apply the “how I would buy” philosophy and don’t embrace the “how your target market would find you” mentality!

Many agencies, 57.69% in fact, outsource some or all marketing, and we actually applaud this. While we champion agencies having an onsite and in-person marketing professional, one person can’t do it all today. You need someone who is an SEO strategist, graphic designer and video editor. While someone can be an expert in one of these fields, it’s rare to find a designer who can also be an email database manager!

The observation is that people who perform well at one level are promoted to a higher level of responsibility and eventually can find themselves overcome by the demands of the new position. As you consider the growing demands of leadership, don’t assume you can handle it with your own raw talent and determination. Remember to invest in your own personal professional growth and consider a performance training day for you and your leadership.

Agency owners, listen now! I have had an email address for way more than half my life, and this was when dial-up was a thing! Email is not going away, and as an agency owner, you need to get even basic email marketing up and running. We need to let go of the idea of integration. I almost never see a management system clean enough to integrate complicated data. But with a basic Mailchimp account you can nurture your clients and make sure your name is in front of them. It’s a shame that 43.27% of agencies don’t take advantage of even basic email marketing.

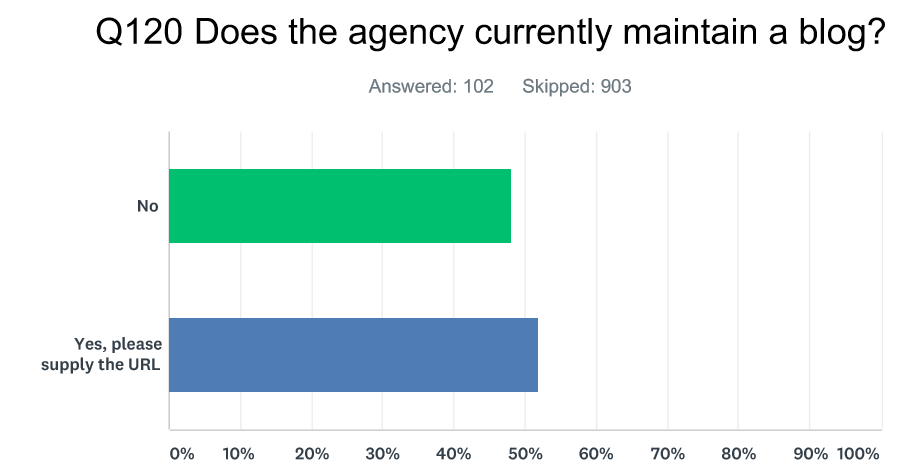

The argument that no one reads insurance blogs is fair. You’re right that no one wakes up thinking, “Yasssss get me the latest blog from my agent! I can’t wait!” However, Google reads your blogs and helps rank your agency. Also, your blogs do not have to be long and boring; you can be creative! However, right now 48% of agencies do not maintain a blog.

Marketing without a plan is dangerous, expensive and silly! However, most agency marketing members feel that the goals are not clear or non-existent. The right marketing plan includes growth in social following, campaign open rates and response, driving traffic to your website and tracking where leads are coming from.

Would you believe that 58.65% of agency staff do not engage in agency marketing? What? They are on the front lines and hear all the questions clients have. They are the heart, the soul of servicing and loving customers. Why aren’t they engaged? Generally, it’s because they don’t understand it and want to stay in their lane. To maximize agency marketing engagement, make sure they understand the importance and how it works!

shhhhhh

INSURANCE SERVICE IS ALSO A SALES ROLE

Ensuring that customers receive great service is an essential piece of any business, but are agencies being honest with themselves about how they rate? Almost every agency I’ve met shares that they pride themselves on their level of customer service. Many even list it as a differentiator between themselves and other agencies when asked what makes them unique.

There are many questions in our Agency Assessment which allow us to gauge a team’s view of themselves, but these observations below will be helpful in testing your own room for improvement.

Overwhelmingly, service staff rate themselves as providing good service (60%) or amazing service (27%). Yet when asked, “Do you prefer to email or call clients back with service answers?”, 48% prefer emailing and 52% prefer calling. In other words, almost half prefer emailing without any client interaction. I’ve been the recipient of some of these emails and have received communications with quote or coverage detail attachments and no personal note, other than the agent’s email signature. It’s human nature to give ourselves good marks on a grading report, but we should find these stats disturbing. By avoiding contact on the phone to discuss service issues with clients, we certainly save time for the agent, but we miss vital opportunities to develop many aspects of a good client/agent relationship. This is just poor service. I always share with agencies: people buy people, not just policies. There is no substitute for a real conversation and the back-and-forth of vital rapport building. It is not the same with an email which can be ignored or simply scanned quickly for the client’s typical objective — reviewing price. By communicating with your clients on a call, you can provide them with a warm greeting, thank them for being a client, explain your personal value as an agent, share the value of your independent agency, verify and update important contact information, provide a quick account review revealing gaps in coverage and opportunities for rounding/cross-selling, provide opportunities for clients to ask questions, empathize with their concerns, and even ask for referrals from clients satisfied with your great service. There is no substitute for your clients getting to know you and like you on a call versus email.

One of the most powerful and immediate ways to drive sales growth in an agency is with the service team, even though many may not consider themselves frontline salespeople. Two powerful truths about your service team are:

- On a daily basis they are constantly interacting with your greatest opportunity — your current book of business

- Sales is just a natural part of good service

If I know that you need something and don’t tell you about it, is that good service? Of course not! Good service from an insurance professional is receiving care from a knowledgeable agent looking out for your best interests. At times, it can even entail painting a clearer picture of value when an agent determines their client is not seeing the benefit of a particular form of protection. Sales training, including practice scripts and role playing, is indispensable in helping your service team pre-plan for overcoming client concerns to help move them toward wise decisions to properly protect their families. Remember, great service includes offering clients a solution to a problem they didn’t even know they had before talking with you!

Fifty-six percent of agents claim that when they see an opportunity for account rounding, they mention it and attempt to sell the policy. This still leaves a large 44% who give it a quick mention and move on, push it back to the Producer, don’t look for additional opportunities to protect clients, or see the opportunities and choose not to offer them.

One of the benefits of offering and providing additional coverage on every call is that retention increases dramatically with a higher number of policies-in-force per client. Yet service teams admit in our assessment surveys that they are unaware of their retention rates, with 88% not knowing their personal retention rate, 89% their department retention rate, and 84% the agency retention rate. Moving your retention rate higher requires first measuring and then communicating where you are currently, as well as sharing progress made each week after training and coaching for improvement through regular practice and accountability. Additionally, while 58% of agencies do not provide annual account reviews for their clients, a proactive strategy of driving agency retention through advanced outbound renewal calls through our AppX Retention program can increase retention an average of 1.5%, and in some cases, much higher.

insurance sales

STARTS WITH TRAINING

Most agencies will fall into two categories when it comes to sales. Either they have dedicated salespeople (these could be internal or more of a traditional Producer) or they have their Account Managers / CSRs handle new business.

Either way, it is very common for us to see a lack of focus on sales process and metrics as part of the assessment. If there is a separate department, there is usually a little more focus. Often total premium and/or revenue and occasionally some type of yield, conversion, or close rate is calculated. Often there are no goals, routine discussions around sales or accountability/incentives for sales.

The three most surprising stats we have seen from the over one thousand responses we have received in our survey as part of the Agency Assessment are:

We often find many agencies only participate in insurance training. While CEs and designations are important and knowledge of the product is vital, there is very little soft skill training that occurs. How to provide an excellent customer experience, creating and following a sales process and simple selling skills are typically items not discussed in an agency, never mind having some training around them. This is one of the many reasons why I often hear “I’m not a natural salesperson” or “I’m not in sales” when I talk with Account Managers. While there are “natural salespeople,” everyone can learn basic selling skills, especially when it comes to providing education and being collaborative which are traits that typically line up more naturally for an Account Manager.

This one always amazes me — not because it’s surprising, but because of how the conversation typically goes within an agency which is as follows:

- Me: “How do you get most of your leads?”

- Agent: “Referrals.”

- Me: “Would you say asking for referrals would be vital to your success?”

- Agent: “Well, yeah.”

- Me: “How often do you ask for a referral?”

- Agent: “Um….”

When we provide a great experience (whether it is a new policy for a new client or service work for an existing client), we are providing the person a reason to refer business to us. When we simply add a request for referrals after providing the great experience, we are increasing exponentially the likelihood of them referring us. First, it will actually occur to them to do so. Second, when people are appreciative, they usually like to reciprocate. Third, it sets us apart from other agents with whom they have done business.

I’m not sure how we would know if we are performing well without tracking a number of different sales ratios. Typically we aren’t tracking this because we don’t have a process we are following, and therefore we have no real way to even generate the numbers to be able to track our leads. A simple sales process would be:

- Lead generated

- Contacted

- Quoted

- Sold

Something as simple as tracking those four items leaves us with a number of different metrics we can track which include the four raw numbers as well as six easy and valuable rate percentages.

- # of leads generated

- # of leads contacted

- Contact Rate (contacted/generated)

- # of leads quoted

- Quote Rate (quotes/contacted)

- Lead to Quote Rate (quotes/generated)

- # of leads sold

- Yield Rate (sold/generated)

- Conversion Rate (sold/contacted)

- Close Rate (sold/quoted)

If we are also tracking some simple additional information, we can also break down all of these numbers based on different aspects, such as the employee, office location, town/state, marketing source, department, or LOB. Really any aspect you want to track can be done as long as the information is gathered into some sort of system and the sales process is not only followed but also tracked correctly.

What’s Next?

You may have read this page once, twice or even three times and be puzzled about how to use all this great information! I wanted to give you three easy ways to use this report to benefit your team, agency and clients.

Sharing Is Caring

You don’t have to keep this report to yourself! While emailing this page around may overwhelm your team, you can start strategically using the information. We purposefully broke down the report into bite-sized sections. You can review one section each month with your team, both written and in video. Once you take a week or two to digest the information, you can put your heads together on how to solve the challenges your agency faces. Also, consider sharing this with your carrier reps to see what resources they can also bring to the table.

We caution you to pace yourself. Reviewing all areas of the agency can be exhausting!

Lean on Facts, Not Feelings

As a business owner myself, I know sometimes it’s easy to get rose-colored glasses or complete blackout shades on your business. It seems like things are either going well or horrible! We have to avoid letting our feelings (both high and low) take over our decision making.

We encourage everyone to lean on data points from polls, surveys and team interviews to get the best information. As a business owner, it’s important not to get defensive when you get people’s feedback. Remember, everyone’s perception is their version of reality. Listen and ask questions. People can often come together to create positive solutions.

You Are Not Alone

You don’t have to do this alone! We are here for you. Check out the work with us page for more information.